As technology continues to advance at a rapid pace, the world of investing is also undergoing significant transformations. One area that is experiencing a substantial shift is the process of demat account opening. Demat accounts, which allow investors to hold securities in electronic form, are becoming increasingly popular due to their convenience and efficiency. In this article, we will explore some of the trends that are shaping the future of the demat account opening process.

One of the prominent trends in demat account opening is the digitization of the entire process. Traditionally, opening a demat account involved filling out numerous forms and submitting physical documents. However, with the rise of digital platforms and e-KYC (Know Your Customer) procedures, the account opening process has become more streamlined and hassle-free. Investors can now go for demat account opening procedure online, eliminating the need for physical paperwork and reducing the time required for account activation.

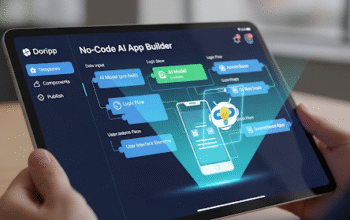

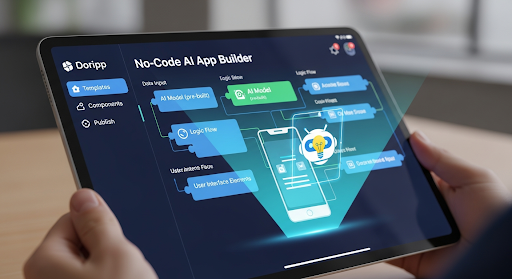

Another trend that is gaining momentum is the integration of artificial intelligence (AI) and machine learning (ML) in demat account opening. AI-powered chatbots and virtual assistants are being developed to guide investors through the account opening process, answering their queries and providing real-time assistance. These intelligent systems can analyze customer data, identify patterns, and offer personalized recommendations, making the account opening experience more tailored and user-friendly and then consider checking Adani power share price.

Furthermore, biometric authentication is emerging as a key trend in demat account opening. Biometric technology, such as fingerprint or facial recognition, provides a secure and convenient way to verify the identity of investors. This eliminates the need for traditional methods of identity verification, such as submitting physical documents or visiting a branch in person. Biometric authentication not only enhances security but also speeds up the account opening process, enabling investors to start investing sooner while considering go for the same Adani power share price.

The rise of blockchain technology is also expected to have a significant impact on demat account opening. Blockchain, a decentralized and transparent ledger system, can enhance the security and integrity of transactions. By leveraging blockchain, demat account opening can become more secure, with tamper-proof records of investor information and transaction history. This technology can also facilitate faster settlement of trades, reducing the time required for funds to be credited or debited from the demat account opening process.

In addition to these technological advancements, regulatory reforms are also shaping the future of demat account opening. Governments and financial regulators are taking steps to simplify and standardize the account opening process, making it more accessible to a wider range of investors. For instance, e-KYC procedures are being adopted in many countries, allowing investors to open demat accounts remotely using their Aadhaar or social security numbers. These reforms are aimed at reducing red tape and encouraging more individuals to participate in the stock market while considering the Adani power share price.

As we look ahead, it is clear that demat account opening is poised for further transformation. The emergence of digital platforms, AI-powered assistance, biometric authentication, blockchain technology, and regulatory reforms are all contributing to a more seamless and secure demat account opening process experience.