When individuals think of making money online, a number of things come to mind. Some may mention side trading as a reasonably risk-free activity, or they may mention some of the more nefarious facets of the internet. However, many forex traders feel that because it is also illegal fraud, it is not really worth trying to understand what is going on here. This is probably because the majority of forex companies are run by con artists who won’t stop pestering you until you’ve fallen for their tricks 100 times. But whether you want to start trading gold or cash alternatives, if you finish this course, you’ll learn how to avoid scams while exploring the mysterious world of foreign exchange trading. Additionally, you’ll learn why almost all forex traders lose money as well as how to avoid falling for the same scams in the future.

Forex is the practice of trading foreign currencies to profit from changing exchange rates. The essential concept of this market, which comes in a variety of forms, is that you buy or sell money that is sufficiently “northeast” (or “eastern”) to trade against. This is done in the FX market, however other investment markets like the stock market also permit it. When someone sells you anything, you have to buy it from them at the agreed-upon price. If you want to make money from trading foreign exchange, you must be aware of the differences between “retail” and “exchange” prices. There may occasionally be a difference between the “exchange” price and the “retail” price. You would purchase at the “exchange” (or “delivery”) price and sell at the “retail” price in order to make a profit.

If the individual trading with you is not who they claim to be, says a reliable MetaTrader 4 specialist, that could be a sign that you’re dealing with a forex scam. Another is if they try to sell you something that they know they can’t sell, like investing advice or a trading program. Additionally, refrain from promising great returns on investment prior to presenting evidence. Another red flag you should look out for is if you’re handing the trader a substantial chunk of your net worth. This makes it abundantly clear that you need to worry about the broker’s ability to pay off their debts.

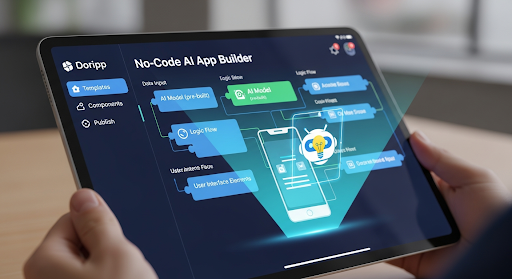

The foreign exchange market is complex. There are several different markets where people can trade currencies, and each one has its own set of rules. This is far more complicated than it seems, despite the fact that it may seem simple. According to a MetaTrader 4 broker, the good news is that you may avoid the majority of the challenges and begin trading easily with the right software. But you must first recognize the underlying reason for its complexity. Conceptually, trading on the stock market and the foreign currency market are extremely similar. By investing in assets that will appreciate in value, like stocks in corporations, or assets that will depreciate in value, like shares in corporations, you are hoping to gain money. The “foreign” currencies are your chosen currency and the market you want to trade on since you’re looking to buy assets on the forex market whose value will drop. Why does it matter where you exchange currencies? In addition to being familiar with the market where the currency is exchanged, you also need to know what its “retail” price is. If you are aware of “retail” pricing, you may decide what you need to buy or sell in order to achieve that price. However, you can make a mistaken assumption if you don’t know the “retail” pricing.