Uncovering the Future: Predictive Modeling with Option Chain

Technology Posts News

Why True Luxury Interiors Take Time

Speed is often treated as proof of efficiency. In high-end interiors, speed can be the…

Environmental Impact of Custom Carrier Bags

Packaging choices quietly shape a brand’s environmental footprint. From material sourcing to end-of-life disposal, custom…

How Subtitle Translation Adapts Language for Viewers

Subtitles shape how global audiences experience film, television, and digital media. Every line must balance…

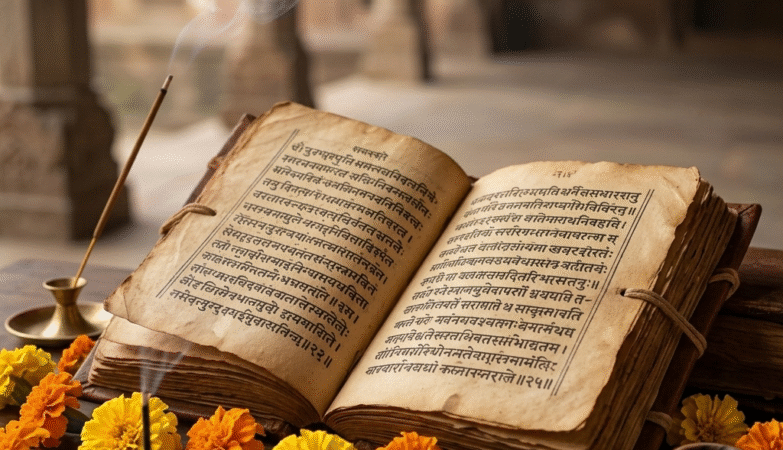

Exploring Yoga Philosophy Through Ancient Sanskrit Texts

Most people come to yoga through a pose. They stay because of something deeper —…

How Many Samsung Double Doors Fridge Prices Are There?

Introduction. Samsung is synonymous with cutting-edge technology and top-quality appliances. Among its superior range of…

How LTCG on Property Differs From Other Capital Gains Tax

Selling a property can create a significant tax liability, especially when the sale results in…